Key Takeaways

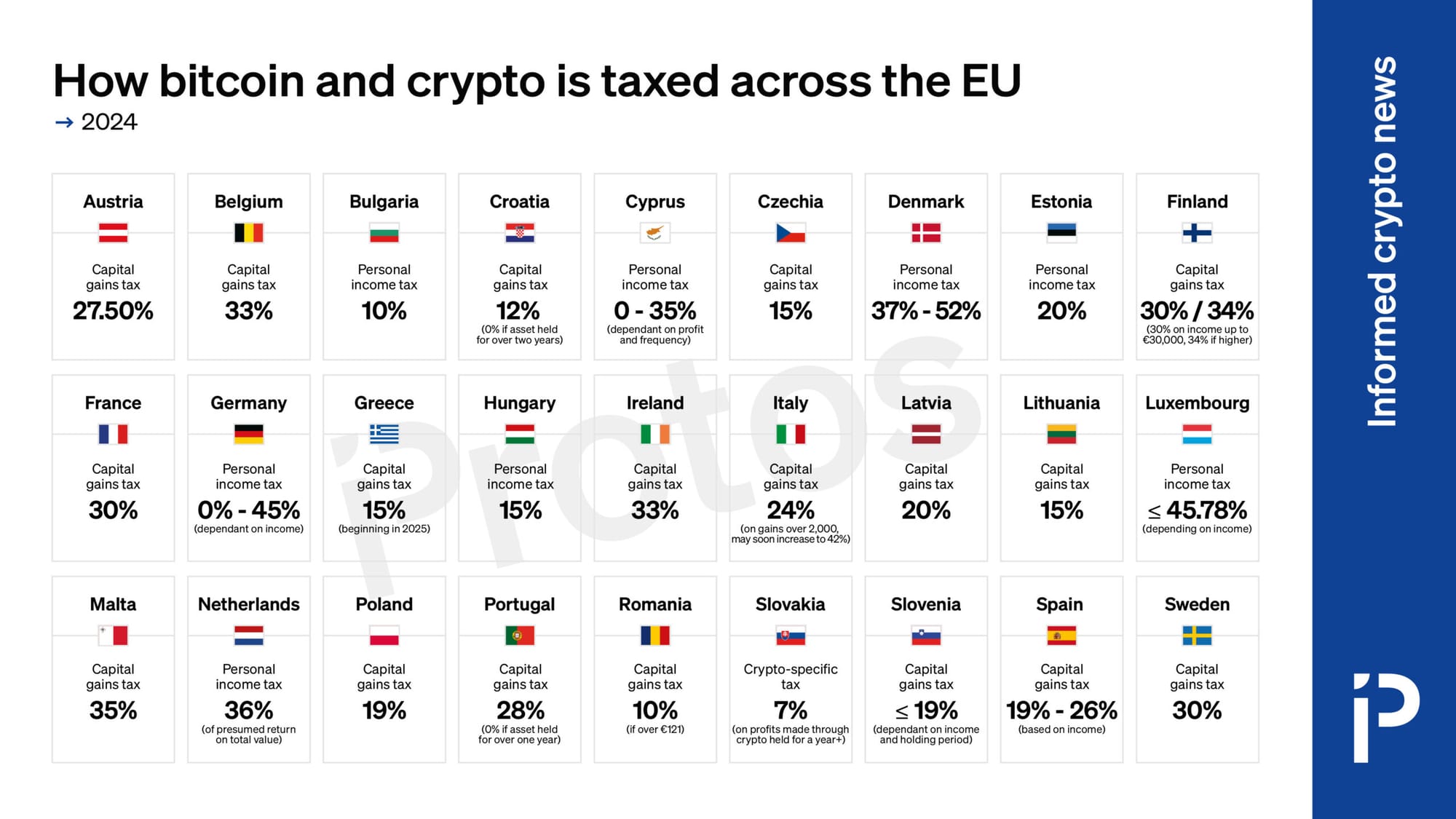

- Italy plans to raise the capital gains tax on Bitcoin from 26% to 42%, significantly impacting crypto investors.

- The government aims to remove the minimum revenue requirement for its Digital Services Tax, affecting large digital companies operating in Italy.

- The new tax measures are part of Italy's 2025 budget plan, designed to fund government services.

Italy Proposes Raising Bitcoin Capital Gains Tax to 42%

Italy plans to raise the capital gains tax on Bitcoin investments from 26% to 42%, according to a new budget proposal.

Deputy Economy Minister Maurizio Leo announced the change during a news conference on October 16, 2024, at Palazzo Chigi.

The proposed tax hike is part of Italy's broader budget plan, which was approved by the Council of Ministers.

The final decision on the tax increase is pending approval by the Italian parliament.

Digital Services Tax Changes Also on the Table

Italy is set to remove the minimum revenue requirement for the Digital Services Tax, or web tax.

This tax previously applied to companies with at least 750 million euros in global revenue and 5.5 million euros from digital services in Italy.

Broader Budget Aims to Fund Public Services

Italy’s 2025 budget, valued at 30 billion euros, will partly be funded by a levy on banks and insurers.

Prime Minister Giorgia Meloni has stated that no new taxes will be imposed on citizens under the current budget proposal.

[Original Article]